In today’s world, it’s common to see stores offering things like furniture, electronics, appliances, phones, or even medical procedures with a deal that sounds almost too good to be true: “No interest for 12 months.” On the surface, the offer seems like a perfect opportunity—buy now, enjoy now, and pay later without spending an extra penny. For many people, especially those who prefer spreading payments over time, this type of financing can feel like a lifesaver.

But the truth is more complicated. These offers can save you money or they can cost you a lot more than you planned. Whether it is a good idea depends entirely on how you manage the payments, your budget, and the fine print that most people never read.

This article explains everything in simple, easy-to-understand language.

What “No Interest for 12 Months” actually means:

When a store advertises “no interest for 12 months,” most people think:

“I can take 12 months to pay, and I won’t be charged any interest as long as I make my payments.”

That sounds great, right? But here’s what most people don’t realize:

Most of these deals are NOT true 0% interest.

Instead, they are what’s called deferred interest.

This means:

- Interest is being calculated in the background the entire time.

- You just don’t have to pay it if you pay off the full amount before the 12-month period ends.

- If you don’t pay it off in time—even if you only owe $1—you get charged all the interest from the beginning.

In other words, the store is not giving you free money. They’re giving you a chance to avoid the interest—but only if you follow their rules perfectly.

An example in simple words:

Imagine you buy a $1,200 TV with a “no interest for 12 months” deal.

If this deal uses deferred interest (most do), here’s what’s happening silently:

- The store has a hidden interest rate: usually 25–30% APR.

- Interest is building every single month, but you don’t see it.

- If you finish paying within 12 months, they erase the interest.

- If you do not finish—even by a small amount—you get hit with all 12 months of interest at once.

So let’s say you still owe $100 at the end of 12 months.

You might suddenly be charged $300–$400 in interest.

This shocks many people because they think they did everything right.

Why people fall into the trap:

The main reason people get caught is because they pay only the minimum payment, which is usually very low.

For example:

- Your minimum payment on a $1,200 purchase might be $25 a month.

- If you only pay $25 a month, you will still owe money after 12 months.

- Since the balance isn’t paid off, the deferred interest is added to your account.

Stores know this. That’s why they offer these deals—they make money when customers slip up.

When “No Interest for 12 Months” is a good idea:

1. You know you can pay it off on time:

If you divide the total cost by 12 and pay that amount monthly, you can safely take advantage of the offer.

Example:

- Total purchase: $1,800

- Payment plan: $1,800 ÷ 12 = $150 per month

- If you pay $150 each month, you finish on time and pay $0 in interest.

This is the smartest way to use no-interest deals.

2. You already needed the item:

If the purchase is essential—a refrigerator, medical procedure, laptop for work or school—then spreading payments without interest can help you manage your budget.

3. You’re disciplined with payments:

If you are the type of person who never misses a due date, sets reminders, or uses auto pay, these deals can truly help. Your discipline protects you from penalties and surprise fees.

4. You budget correctly:

As long as you create a plan and stick to it, a no-interest offer can be safer than putting the purchase on a credit card with 25–30% interest.

When “No Interest for 12 Months” is a bad idea:

1. You struggle with budgeting:

If you don’t track your spending, it’s easy to fall behind and forget to pay more than the minimum.

2. You live paycheck to paycheck:

If small financial setbacks could stop you from making the required payments, the risk of being hit with high deferred interest is too big.

3. You tend to miss payments:

With no-interest deals, even one late payment can:

- Cancel the entire 0% offer

- Trigger all the deferred interest

- Add late fees

- Increase your balance instantly

This is the trap many fall into.

4. You’re tempted to buy more:

Stores offer 0% financing because:

- It makes items feel “cheaper.”

- People buy more when the payment is spread out.

- Customers feel less guilty spending.

If the offer tempts you into buying something you don’t truly need, it becomes a financial burden.

A Real-Life Story:

Let’s say Maria sees a couch for $2,400 and the store promises:

“No interest for 12 months! Only $30 a month!”

Maria thinks, “Wow, I can afford $30!”

But here’s the problem:

- $30 × 12 = $360

- The minimum payment will NOT pay the balance off in 12 months

- After 12 months, she still owes almost the full price

Because she didn’t pay it off, the hidden 29% interest kicks in.

Maria suddenly owes hundreds of dollars in interest, even though she made every minimum payment.

This experience happens to thousands of people every year.

Difference between “true 0%” and “deferred interest” :

True 0% APR:

Some credit cards or special financing programs offer real 0% interest.This means:

- No interest is building in the background.

- Even if you don’t pay the full balance by the end, you only start paying interest from that point forward.

This is much safer.

Deferred Interest (Most Store Financing):

This is the tricky kind. If you do not pay the full amount on time:

- All interest from the entire promo period gets added

- Even if you made all payments

- Even if you only owe a tiny amount

Always read the words “deferred interest” in the terms.

How to use a no-interest offer safely:

1. Divide the total cost by 12:

This is your real monthly payment—not the minimum.

2. Set automatic payments:

This protects you from late fees and losing your promo.

3. Pay earlier if you can:

The faster you pay, the less stress you experience.

4. Don’t charge anything else on that account:

Additional purchases can mix with promotional balances and create confusion.

5. Put reminders in your phone:

Make sure you know the exact date the promotion ends.

6. Keep track of the balance:

Check your statements to ensure you’re on track to finish in 12 months.

Benefits of no-interest offers:

- You get time to pay without extra cost

- Helps you afford large purchases responsibly

- Keeps money in your bank longer

- Can be safer than using high-interest credit cards

- Can help build credit if payments are on time

Risks of no-interest offers:

- Deferred interest can be extremely expensive

- Minimum payments won’t pay off the balance

- One late payment can cancel the offer

- Terms are often confusing

- People may overspend

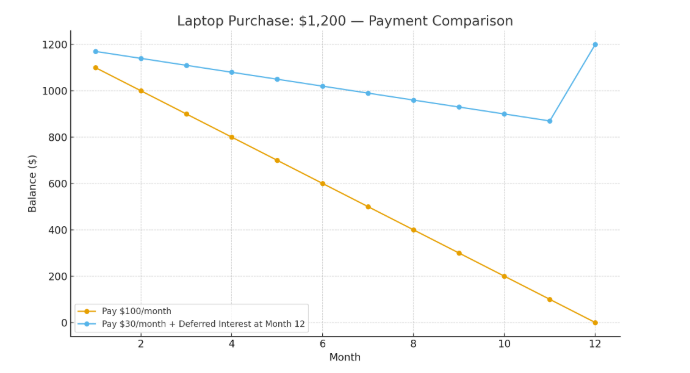

A Simple Example Chart:

Imagine you buy a $1,200 laptop:

- If you pay $100 per month → Balance becomes $0 in 12 months → You pay no interest.

- If you pay only $30 per month → After 12 months you still owe around $840 → Store adds full interest from the entire year → New balance becomes much higher.

A simple chart showing two lines:

- The $100/month line going straight down to zero

- The $30/month line barely dropping, then suddenly rising when interest is added

How to Know If the Deal Is Right for You:

Ask yourself:

- Can I divide the total by 12 and comfortably pay that amount every month?

- Do I understand whether this is deferred interest?

- What happens if my financial situation changes?

- Am I buying something I truly need?

- Do I usually pay bills on time?

If your answer is “yes” to at least 3–4 of these, the deal may be safe.

If not, consider saving up or buying a cheaper item.

Who should use these offers:

- People with stable income

- People who are disciplined with payments

- People buying essential or planned items

- People who can pay off the balance early

Who should avoid these offers:

- People who live paycheck to paycheck

- People who struggle with budgeting

- Anyone who often pays bills late

- People who get tempted by big purchases

- Anyone who doesn’t fully understand the terms

Conclusion: is it a good idea or not?

Yes, buying items with “no interest for 12 months” can be a good idea—but ONLY if you use it correctly.

If you pay off the full amount within the promotional period, you get the item at no extra cost. It’s like receiving a free loan. It can help you manage your cash flow, avoid high interest, and make large purchases more manageable.

But if you:

- pay only the minimum

- miss payments

- or fail to pay the full balance by the end of 12 months

Then the deal becomes one of the most expensive ways to finance a purchase because of deferred interest.

The key is discipline.

Know the rules.

Make a plan.

Stick to it.

Used wisely, 0% financing can help. Used carelessly, it can trap you in expensive debt.